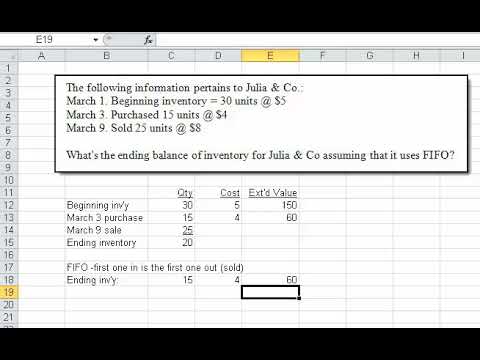

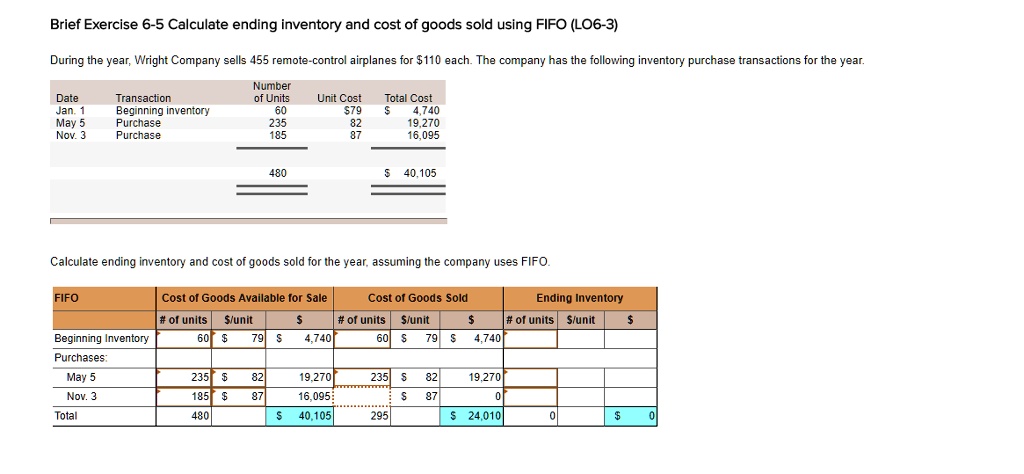

SOLVED: Brief Exercise 6-5 Calculate ending inventory and cost of goods sold using FIFO (LO6-3 During the year, Wright Company sells 455 remote-control airplanes for 110 each. The company has the following

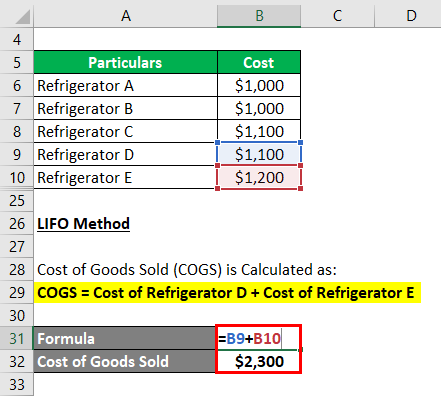

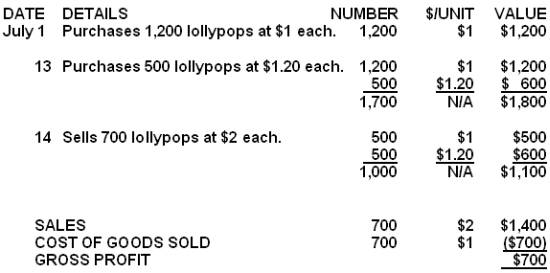

423 Calculate Cost of Goods Sold Using LIFO & FIFO | Calculate Cost of Goods Sold Using LIFO & FIFO | By Accounting Instruction, Help, & How To | Facebook

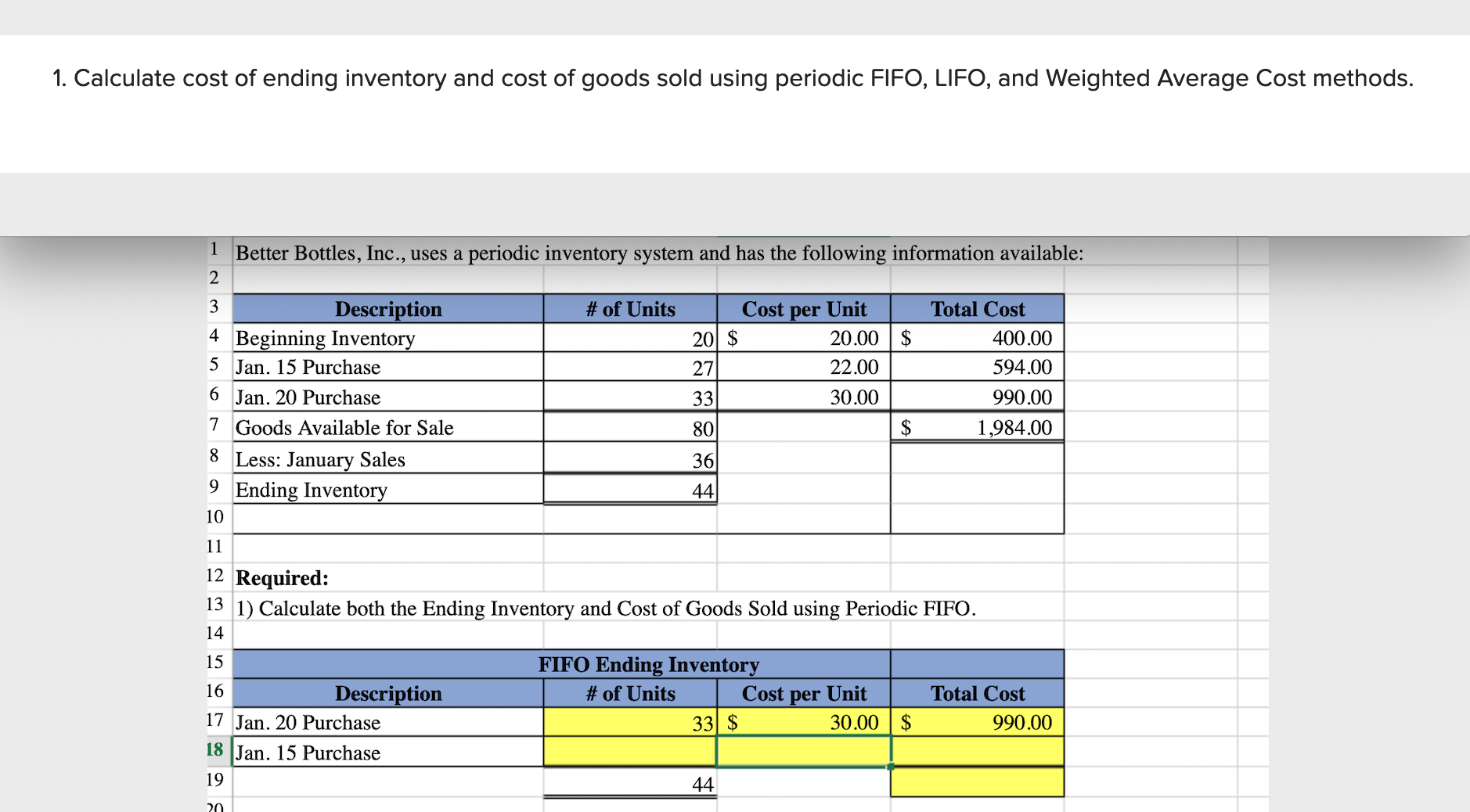

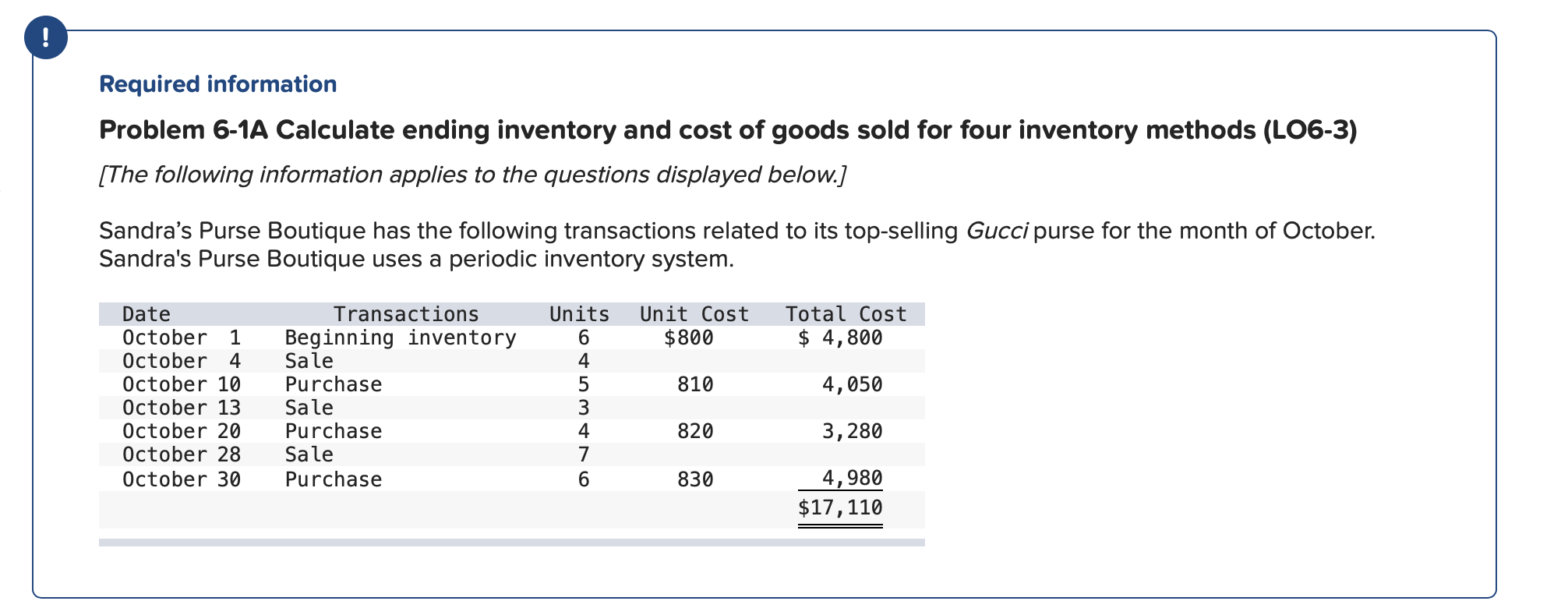

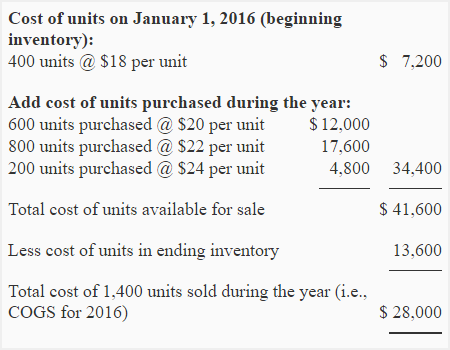

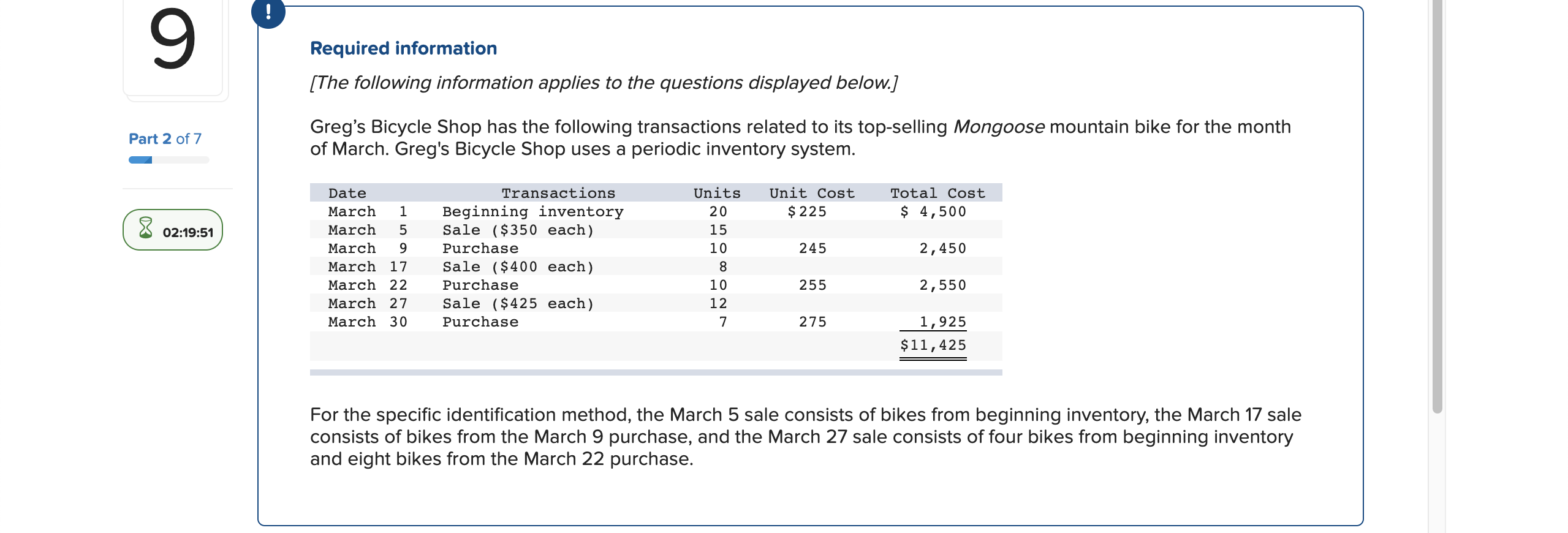

LO 7.2 Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method – v2 Principles of Accounting — Financial Accounting

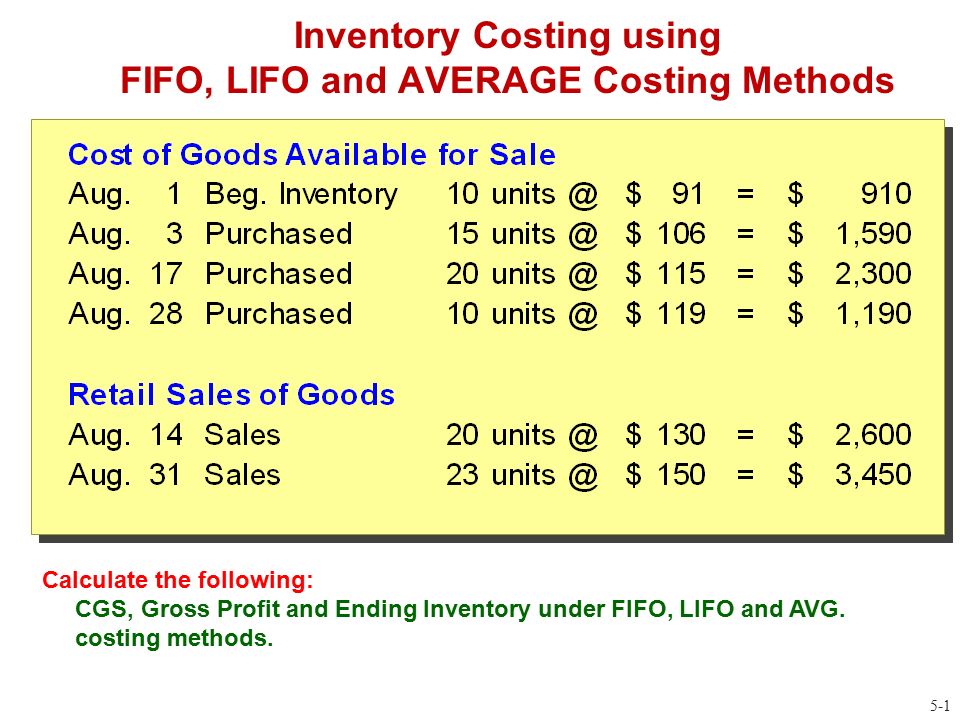

Inventory Costing using FIFO, LIFO and AVERAGE Costing Methods 5-1 Calculate the following: CGS, Gross Profit and Ending Inventory under FIFO, LIFO and. - ppt download

10.2: Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method - Business LibreTexts

Can someone help me calculate the ending inventory and cost of goods sold for this problem? : r/Accounting