Nitin Bhatia on Twitter: "🔴🔴 As promised in yest video, i took help of following article to calculate IV..They have also shared python code which can be modified slightly https://t.co/IhwAU9jFSE" / Twitter

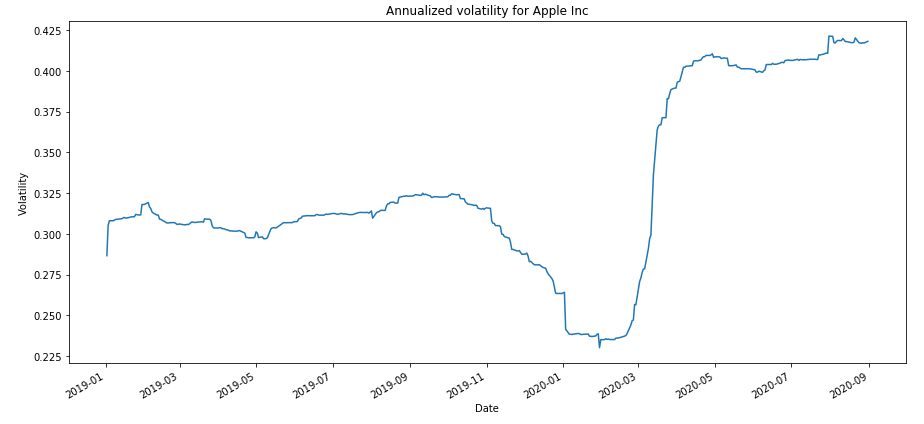

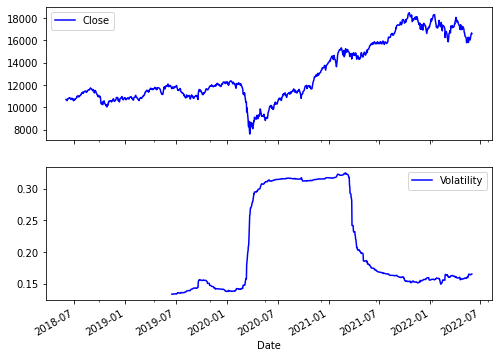

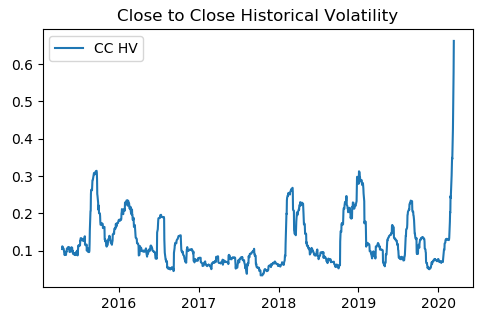

How to Calculate the Daily Returns And Volatility of a Stock with Python | by Khuong Lân Cao Thai | Dev Genius

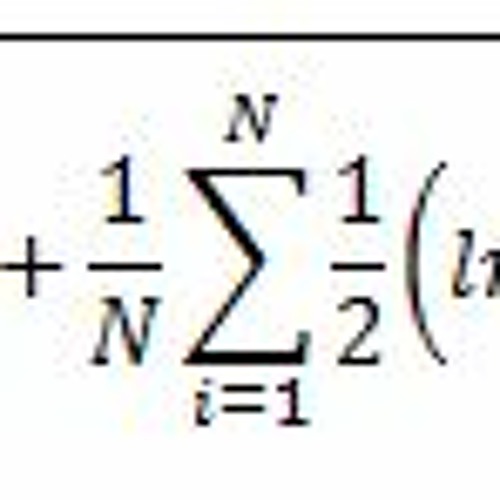

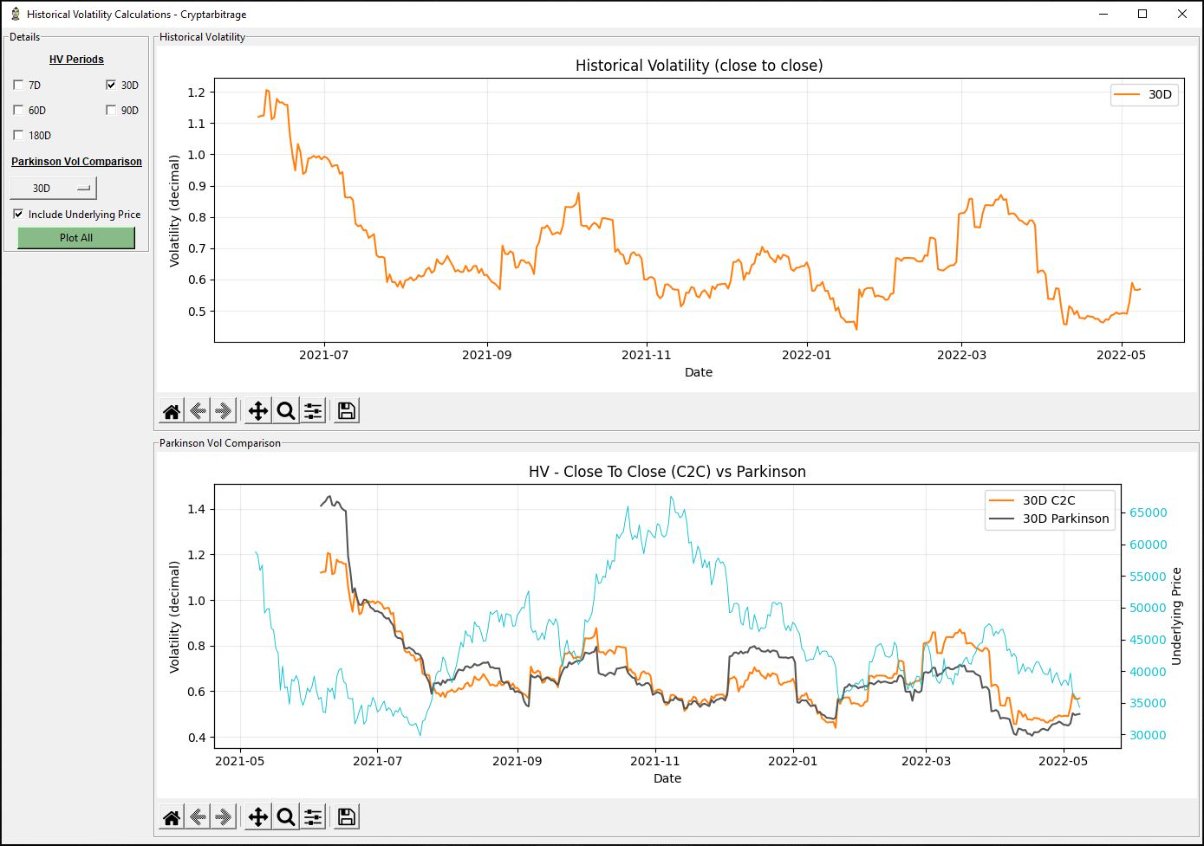

Close-to-Close Historical Volatility Calculation - Volatility Analysis in Python - Harbourfront Technologies

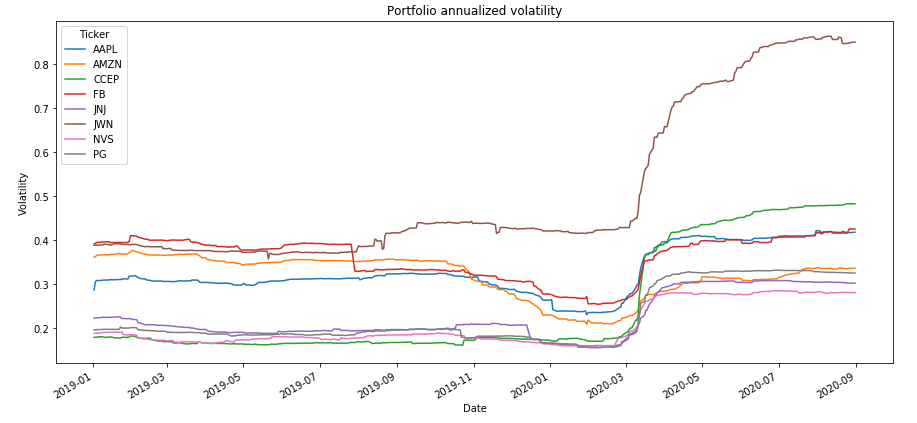

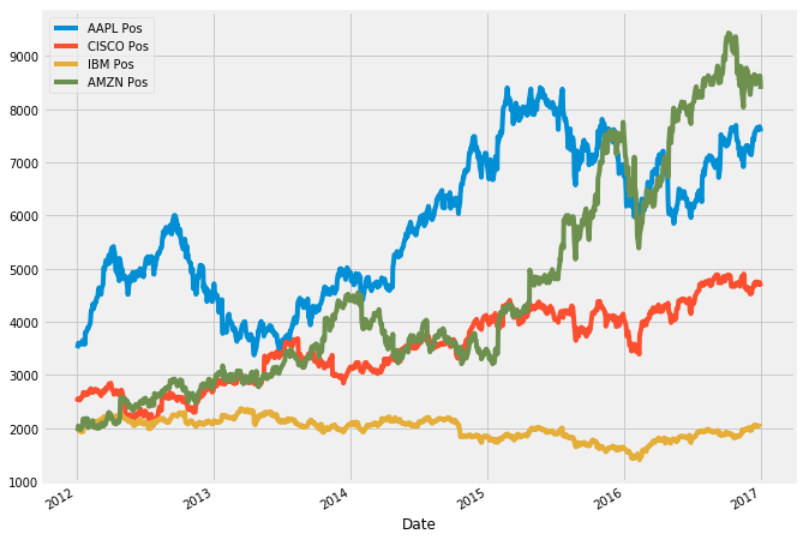

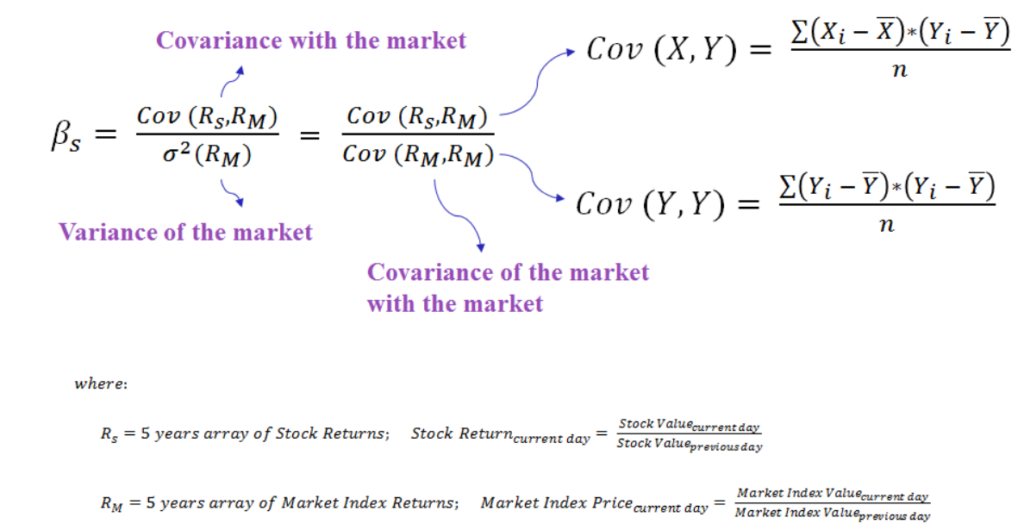

The Beta, as an estimator of volatility in the stock market. Custom calculation in Python. – Jose Luis Fernández Data Science

The Beta, as an estimator of volatility in the stock market. Custom calculation in Python. – Jose Luis Fernández Data Science