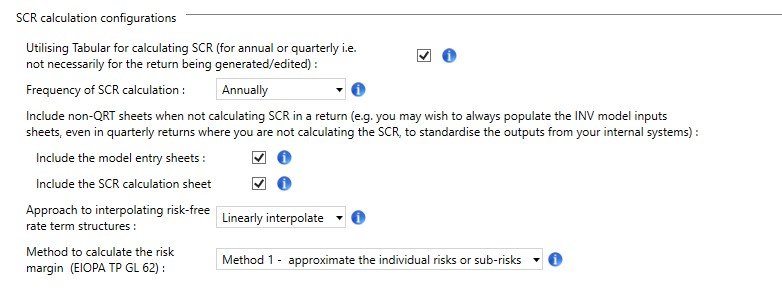

Solvency Assessment and Management: Steering Committee Position Paper 113 (v 3) The calculation of tax in technical provisions

PDF) Risk Based Approach to Calculate General Motor Insurance Reserve using High Performance Computing

Binance on Twitter: "The formula to calculate margin risk level: Margin Level = Total Asset Value / Total Borrowed + Total Accrued Interest If your margin level drops to: 1.3 you will

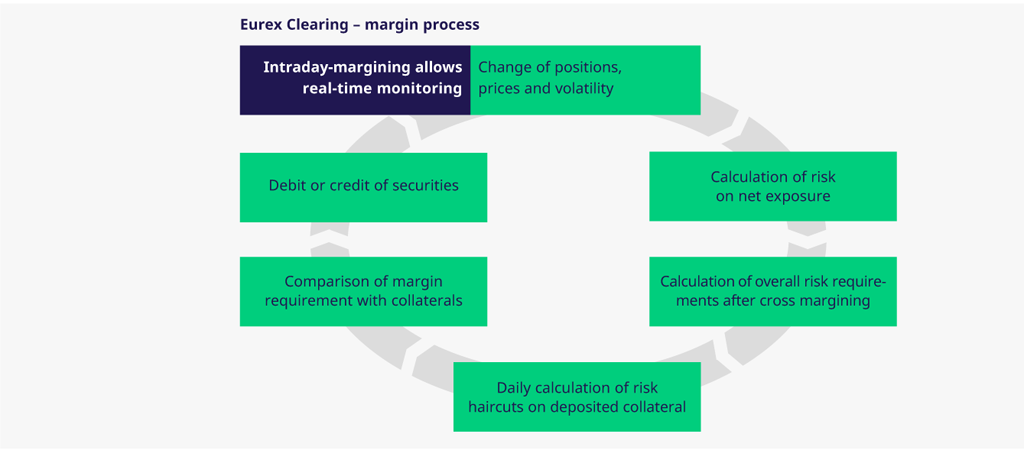

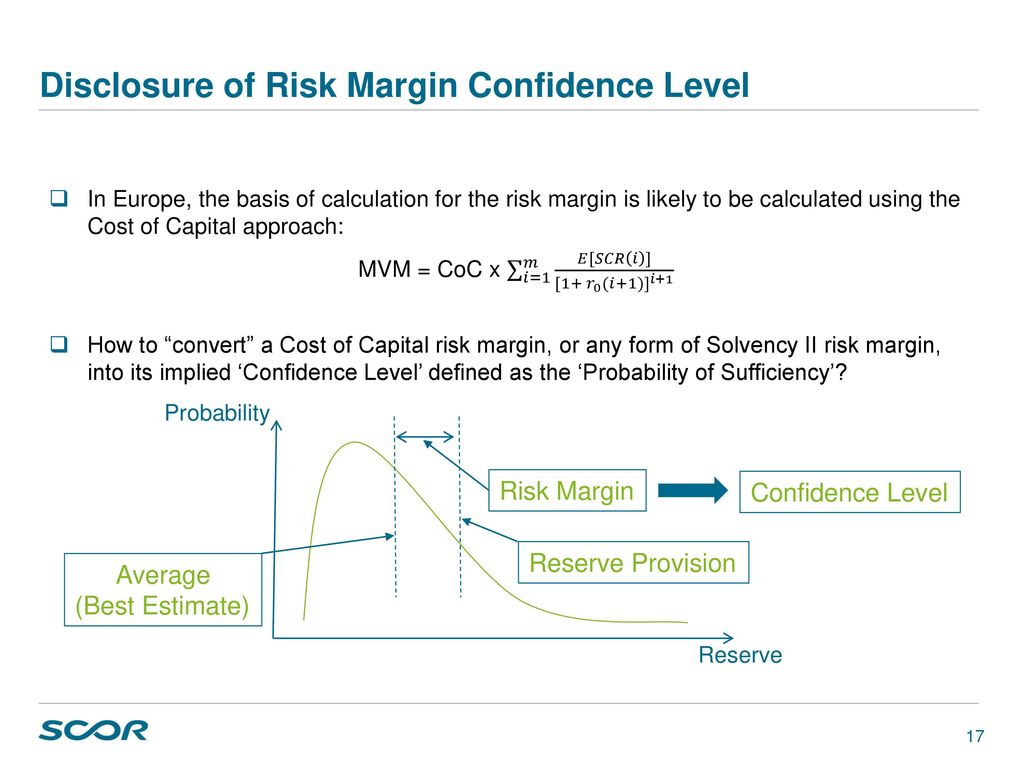

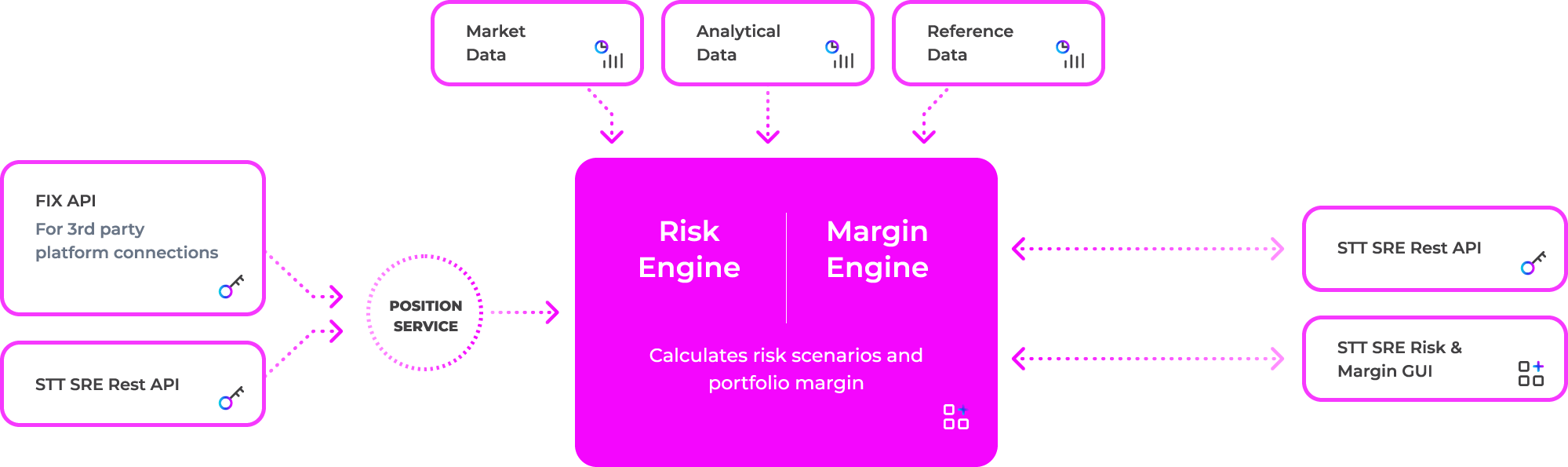

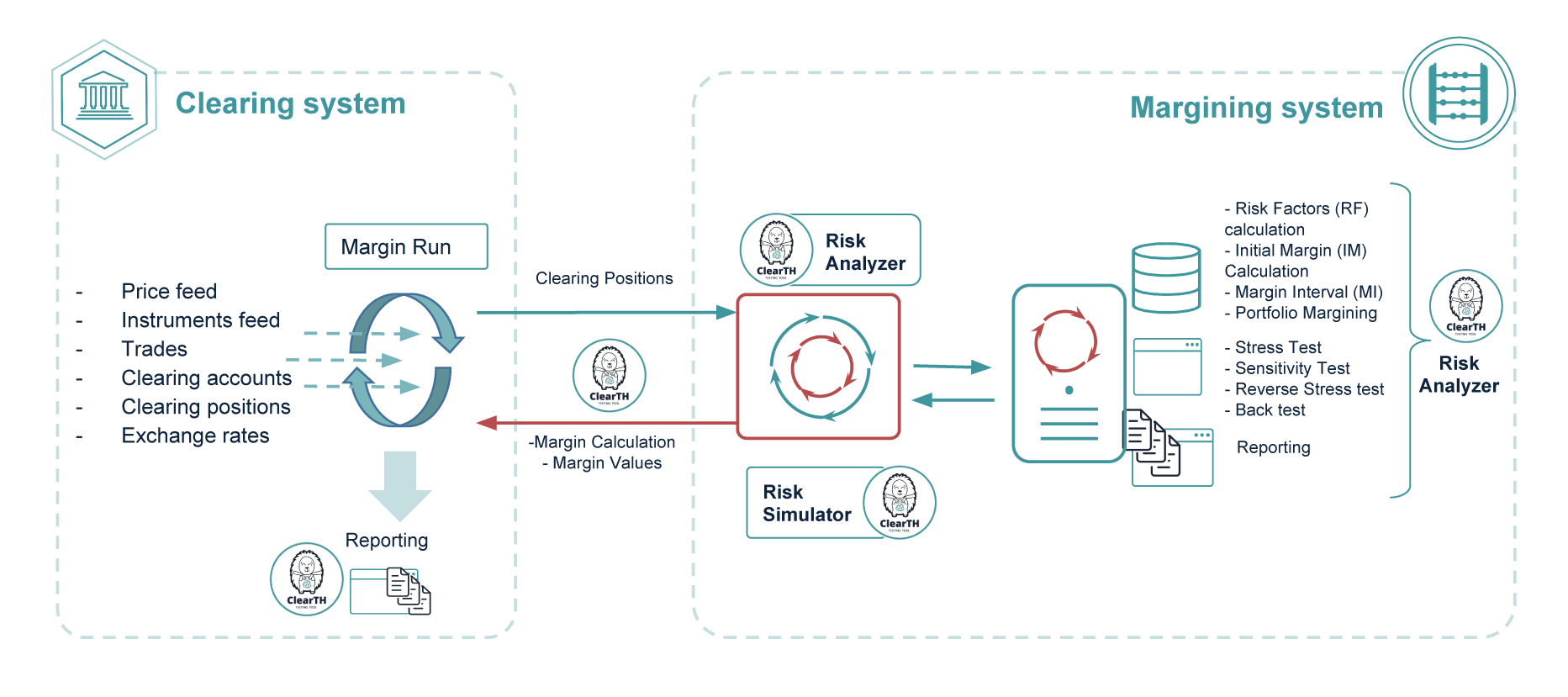

Margin Requirement Calculation Step 1 A = Initial Margin Multiplier * Risk Margin = 1.75 * Risk Margin Step 2 If the port has o

:max_bytes(150000):strip_icc()/margin-Final-872dda45cc4243cc958fe841e452a1b0.jpg)